An official from Dallas County’s budget office revealed that, thanks to the government-mandated economic shutdown, the county is millions of dollars deep in a budget black hole, and they’re showing signs of moving towards raising taxes on already suffering taxpayers—despite Dallas already raising tax bills and spending over the course of six years.

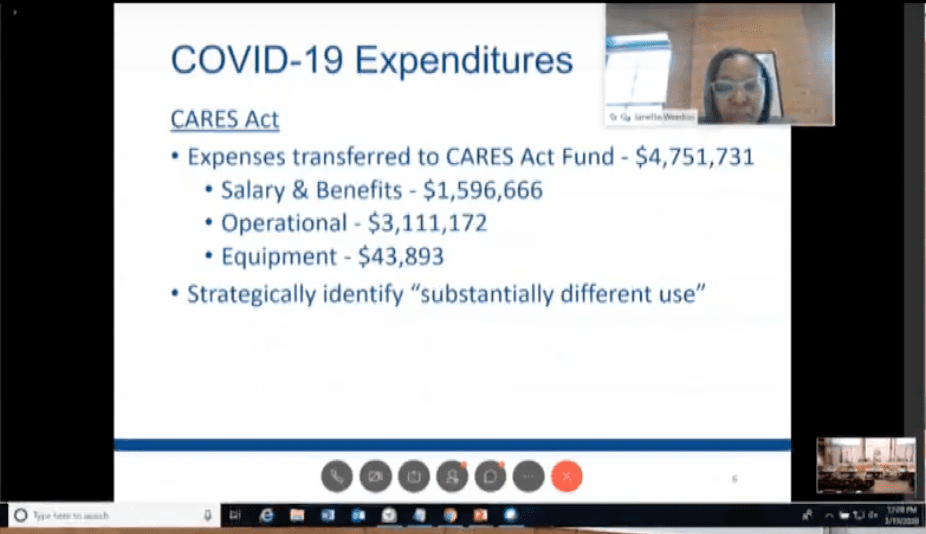

At Tuesday’s commissioners court meeting, Janette Weedon of the county’s budget office updated the commissioners on the county’s finances. To date, Dallas County has spent over $4 million on coronavirus-related expenses.

“More recently, the treasury released additional guidance on May 6 regarding substantially different use,” Weedon said in regards to federal taxpayer funds given to local governments through Congress’ $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act.

“So, for example, if you have expenses that were included in your [FY2020] budget, now those expenses … can be deployed for a different purpose; you may be able to cover the cost of that expense under the CARES Act.”

Dallas County received $240 million in cash directly from the U.S. Treasury as part of the CARES Act’s $150 billion Coronavirus Relief Fund.

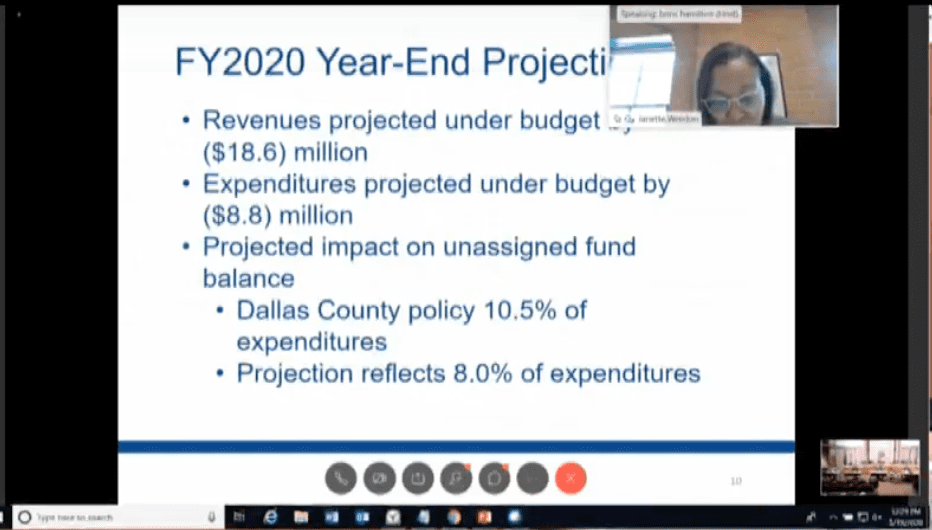

Weedon also revealed there is now an $18 million budget black hole for Fiscal Year 2020. She said they have made only $8.8 million in cuts.

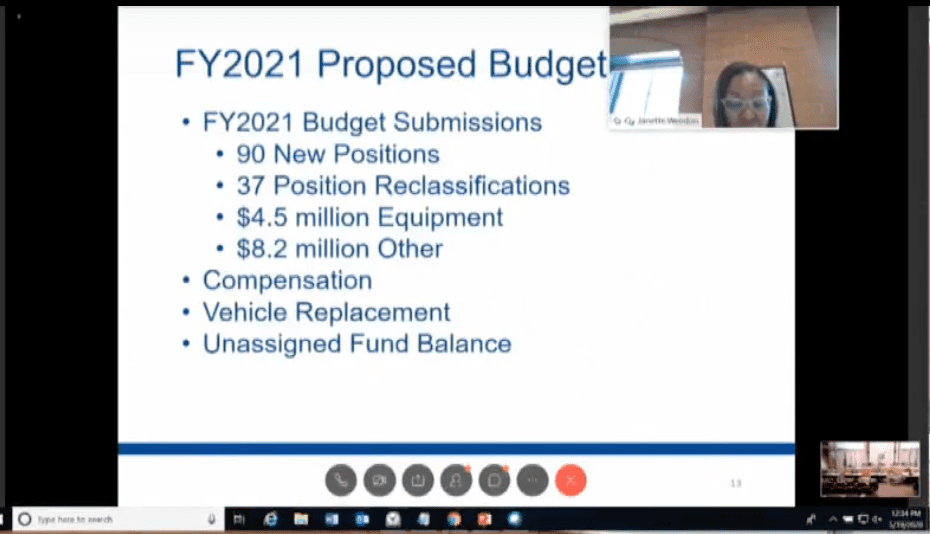

However, in the budget planning for Fiscal Year 2021, Dallas appears to be preparing to spend more, not less. They propose hiring 90 new positions and spending over $4 million on “equipment” and over $8 million on “other” areas, not including compensation and vehicle replacement.

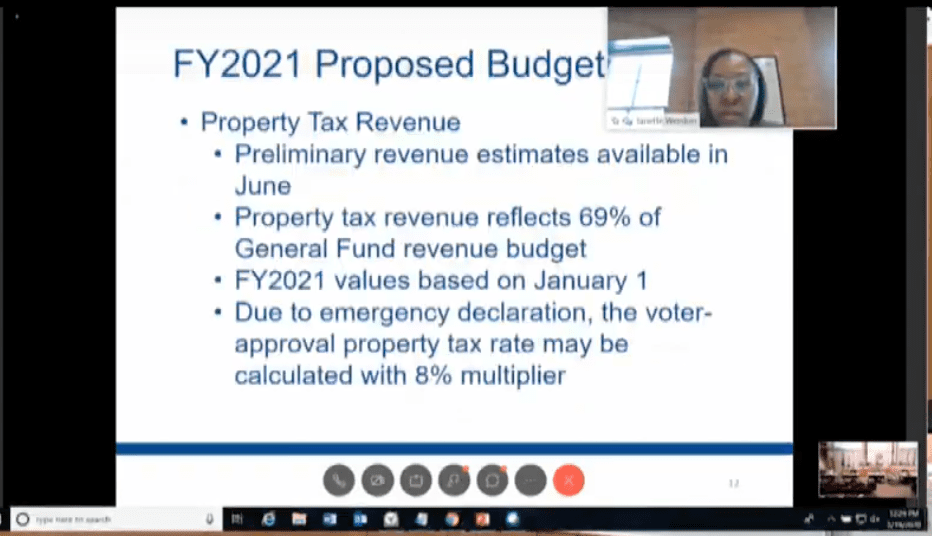

Apparently, the plan to pay for these expansions is apparently not to make cuts elsewhere but to raise property taxes, which make up 69 percent of the county’s revenues. It also appears they are considering ignoring the Texas Legislature’s 2019 property tax reform.

Texas Attorney General Ken Paxton has said the coronavirus doesn’t fit the reform’s “disaster” clause, which would allow local governments to raise property taxes as high as 8 percent more from the previous year without voter approval. Under previous tax law, voters had to trigger a tax ratification election through a petition. 2019’s property tax reform makes this election automatic if most cities or counties attempt to raise property tax revenues over 3.5 percent from the previous year.

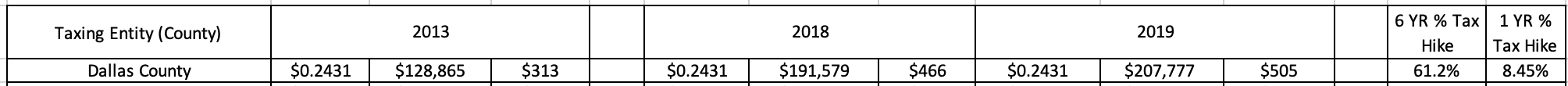

According to data from the Dallas Central Appraisal District, from 2013 to 2019, the county’s average property tax bill for homeowners rose over 61 percent—from $313 to $505—and over 8 percent from 2018 to 2019—up from $466.

In Fiscal Year 2013, the county commissioners approved general fund spending of over $449 million. In Fiscal Year 2019, they approved general fund spending of over $550 million—an increase of over 22 percent.

With taxpayers having to curb their own personal spending, should not their elected officials do the same, rather than just taking more money from those struggling the most?

Commissioners will vote on Dallas County’s tax rate on September 15. City and school tax rates are set separately by each local taxing entity. School tax rates are typically set in May and June.

District 1 Commissioner Dr. Theresa Daniel: Theresa.daniel@dallascounty.org, 214-653-7473

District 2 Commissioner J.J. Koch: jj.koch@dallascounty.org, 214-653-6100

District 3 Commissioner John Wiley Price: John.Price@dallascounty.org, 214-653-6671

District 4 Commissioner Dr. Elba Garcia: Elba.GarciaDDS@dallascounty.org. 214-653-6670