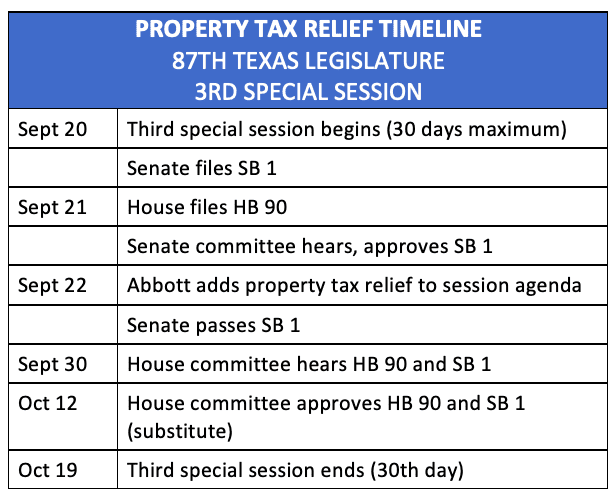

Two proposals to lower Texans’ property taxes are finally moving toward a vote in the Texas House, but it may be too late for lawmakers to deliver property tax relief before the third special legislative session ends.

House Bill 90 and Senate Bill 1 received public hearings in the House Ways and Means Committee on September 30 but remained stalled for over a week.

On Tuesday, committee members finally approved both tax relief bills.

House Bill 90 by State Rep. Tom Oliverson (R–Cypress) would use surplus state dollars to replace some of the local tax dollars that pay for school districts’ maintenance and operations (M&O).

Oliverson’s plan provides permanent property tax relief by applying 90 percent of each year’s state surpluses (if any) to reduce school M&O taxes.

HB 90 is part of the Texas Public Policy Foundation’s “Lower Taxes, Better Texas” plan to eliminate all property taxes by 2033.

Senate Bill 1 by State Sen. Paul Bettencourt (R–Houston) originally proposed using excess state revenue for one-time school tax relief, saving the average Texas homeowner about $200-$400.

A substitute version approved by the House committee would distribute federal COVID recovery funds to Texas homeowners as one-time property tax relief, and it would also create a joint interim committee to study the tax burdens on property owners and “identify potential solutions to reduce those burdens.”

Now the bills go to the House Calendars Committee, where members will decide when to put them on the calendar for a vote by the full House.

But time is running short. Special sessions last a maximum of 30 days, meaning the ongoing session will conclude by October 19.

Lt. Gov. Dan Patrick and House Speaker Dade Phelan identified property tax relief as a priority in advance of the session, which began on September 20. Gov. Greg Abbott added the issue to his agenda on September 22.